The Right Tail, The Right Question

With the eye-popping short squeeze and subsequent collapse in Gamestop (GME) pointing to increasing speculation, if not, outright mania, investors are right to ask whether they are focused on the wrong side of the return distribution.

As investors who usually hedge the first-order directionality of options, we think the focus on buying puts versus calls, though, is misleading.

The right question is not whether a stock is going to go up or down but how quickly. Both questions are tough to answer but if you are going to actively trade options, the second question is, in many ways, more important than the first.

Anybody who taken a first-year class in options can tell you that an option payoff can be nearly replicated by a combination of borrowing and lending of cash and trading in the underlying stock…assuming the volatility is constant. This last point is critical and, we think, sometimes forgotten by infrequent users of options.

Sure, it’s nice knowing that you can lose a limited amount by owning options. But if either the volatility of the underlying finishes well below the volatility that you paid for the option or the market’s prediction of future volatility drops after purchasing the option, then it can be very difficult to make money and, over time, paying too much for options can be a meaningful drag on returns.

Just ask anybody who bought GME January 2022 50 strike put options on the day that it closed at $347. The puts were trading around $25. As of February 4th, the stock has dropped a whopping 80%+ and those same put options are trading around…$25. In the case of GME, it’s not that the actual volatility has been so low but that the option market’s expectation of subsequent volatility has cratered. The effect is similar: the owners of the puts got the direction right (in a big way) and have still not profited from it.

GME is obviously an extreme example but we wanted to use this concept on something more relevant to most investors. Specifically, we wanted to know what history indicates about whether investors should replace their US large cap equity exposure with call options.

To answer the question, we ran the following analysis in which we measured the historical outperformance based on current premiums of owning calls relative to an outright stock position. For example, each data point compared the current price of a call with the market-adjusted outcome of some historical path.

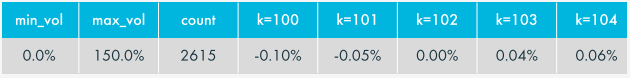

Here’s a summary table of the average of outperformance based on one month overlapping weekly returns since 1971.

Figure 1: Summary table of the average of outperformance based on one month overlapping weekly returns since 1971

Source: Capstone

At first glance, it appears that owning calls at current levels looks quite reasonable. An average loss of only 10 bps and even an “expected” gain for the further out-of-the-money calls? Hard to argue, given the environment, that replacing some equity exposure with calls is likely to be a loser.

Before investors reach that conclusion though, we would suggest slicing the data in two different ways. Both attempt to better account for some of the biggest markets moves over the past few decades.

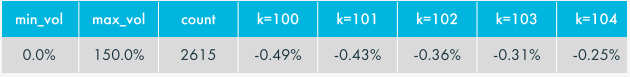

The first method looks only at the median result for each strike.

Figure 2: First Method - Median result for each strike

Source: Capstone

The second method groups the results for each strike by volatility bucket.

Figure 3: Second Method - Grouped results for each strike by volatility bucket

Source: Capstone

Both techniques, we think, reveal something rather important that a simple look at averages might miss. The volatility regime really matters to users of options.

Sure, if one is going to replace a slug of their equity exposure call one time because they have a hunch the market might take a dive but still want to be invested in case they are wrong, then looking at averages and medians might be overkill.

But, essentially, what the bucketed data shows (and the median hints at) is that owners of options at current levels are swimming against a pretty strong tide, if delivered volatility is going to be below 15% over the life of the option.

What will deliver volatility be over the next month? We have no idea. Predicting delivered volatility over such a short time frame is as useful as predicting short-term market direction. What we can say is that for the last month, the S&P 500 has delivered 16% volatility and for the last three months, it has been 14%.

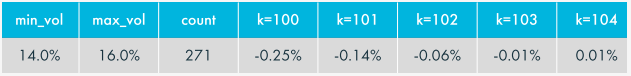

Here are the results of the 14% to 16% bucket.

Figure 4: Results of the 14% to 16% Bucket

Source: Capstone

In other words, if one thinks the volatility regime of the last few months is likely to persist, then short-dated at-the-money calls are slightly rich while further out-of-the-money calls look closer to “fair value”. Not exactly an exciting result but maybe the buyers of GME puts might have found the framework useful a few weeks ago.

Disclaimers

The content of this document is confidential and proprietary and may not be reproduced or distributed, in whole or in part, without the express written permission of Capstone Investment Advisors (“Capstone”). The content herein is based upon information we deem reliable but there is no guarantee as to its reliability, which may alter some or all of the conclusions contained herein. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as investment advice. This document is not an offer or solicitation for the purchase or sale of any financial instrument, product or services sponsored or provided by Capstone. This document is not an advertisement and is not intended for public use or additional further distribution. By accepting receipt of this document the recipient will be deemed to represent that they possess, either individually or through their advisors, sufficient investment expertise to understand the risks involved in any purchase or sale of any financial instruments discussed herein. Neither this document nor any of its contents may be used for any purpose without the consent of Capstone.

The market commentary contained herein represents the subjective views of certain Capstone personnel and does not necessarily reflect the collective view of Capstone, or the investment strategy of any particular Capstone fund or account. Such views may be subject to change without notice. You should not rely on the information discussed herein in making any investment decision. Not investment research. The market data highlighted or discussed in this document has been selected to illustrate Capstone’s investment approach and/or market outlook and is not intended to represent fund performance or be an indicator for how funds have performed or may perform in the future. Each illustration discussed in this document has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. This document is not an offer to sell or the solicitation of any offer to buy securities. Capstone is not recommending any trade and cannot since it is not a broker-dealer. Nothing in this document shall constitute a recommendation or endorsement to buy or sell any security or other financial instrument referenced in this document. Past performance is neither indicative of, nor a guarantee of, future results.

Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice.

Alternative investments may exhibit high volatility, and investors may lose all or substantially all of their investment. Investments in illiquid assets and foreign markets and the use of short sales, options, leverage, futures, swaps, and other derivative instruments may create special risks and substantially increase the impact and likelihood of adverse price movements. Interests in alternative investment funds are subject to limitations on transferability and are illiquid, and no secondary market for interests typically exists or is likely to develop.

Capstone is not registered, authorised or eligible for an exemption from registration in all jurisdictions. Therefore, services described herein may not be available in certain jurisdictions. This material does not constitute an offer or solicitation where such actions are not authorised or lawful, and in some cases may only be provided at the initiative of the prospect. Further limitations on the availability of products or services described herein may be imposed. This material is only intended for investors which meet qualifications as institutional investors as defined in the applicable jurisdiction where this material is received.

Reference to Instruments and Indices:

References to indices are included for illustrative purposes only and are not intended to apply that any Capstone fund or account is similar to such index in composition or element of risk.

The S&P 500 Index (SPX) consists of 500 stocks chosen for market size, liquidity, and industry group representation. Itis a market-value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value.

Notice to Investors in California: This information is confidential. If you are not the intended recipient, please delete it without further distribution and reply to the sender that you have received the message in error. This message is provided for information purposes and should not be construed as a solicitation or offer to buy or sell any securities or related financial instruments in any jurisdiction. California residents should review Capstone’s California Privacy Notice:

https://www.capstoneco.com/regulatory-disclosures/#california_consumer_privacy_act

Notices to Investors Outside of the U.S.: Capstone is not registered, authorized or eligible for an exemption from registration in all jurisdictions. Therefore, services described in these materials may not be available in certain jurisdictions. These materials do not constitute an offer or solicitation where such actions are not authorized or lawful, and in some cases may only be provided at the initiative of the prospective investor. Further limitations on the availability of products or services described may be imposed. These materials are only intended for investors that meet qualifications as institutional investors as defined in the applicable jurisdiction where materials are received.

Notice to Investors in Australia: Capstone is regulated by the SEC under US laws, which differ from Australian laws. This material provided to you is factual in nature. It is not an offer or advice, and is not intended to recommend or state an opinion of Capstone. This document in its entirety is prepared by Capstone Investment Advisors, LLC (“Capstone”), a corporate authorized representative (number 1279754) of SILC Fiduciary Solutions Pty Ltd ACN 638 984 602 (AFSL 522145). The authority of Capstone is limited to providing general financial product advice to wholesale clients. Investors should seek independent financial advice before making any investment decisions.

Notice to Investors in Canada: The content of these materials has not been reviewed by any Canadian Securities Regulatory Authority and does not constitute an offer to sell or a solicitation of an offer to buy securities in any jurisdiction where such offer or solicitation would be unlawful, and such content does not constitute an offer to sell or a solicitation of an offer to buy or an advertisement in respect of securities in any province or territory of Canada.

Notice to Investors in China: These materials, which have not been submitted to the Chinese Securities and Regulatory Commission, may not be supplied to the public in China or used in connection with any offer for the subscription or sale of interests in any investment product to the public in China.

Notice to Investors in the European Union and United Kingdom: These materials are only intended for investors that meet qualifications as institutional investors as defined in the applicable jurisdiction where materials are received, which includes only Professional Investors as defined by the Markets in Financial Instruments Directive (MiFID). These materials are not for use by retail clients and may not be reproduced or distributed without Capstone’s permission.

Notice to Investors in Hong Kong: Warning: The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the document. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

Notice to Investors in Japan: No filings have been made with respect to any of Capstone’s Funds in Japan and the strategy is currently not intended for investment by Japanese investors. Thus, we are not providing this material to you for purposes of soliciting an investment in Fund securities by you or your client investors, but rather to illustrate the manner in which we would plan to manage an asset management mandate (structured in a mutually acceptable and compliant form) granted to us by you should you so elect. By accepting this material, you acknowledge, confirm and agree that you have never been contacted by a representative of the Fund or its manager in any manner which may amount to an offer to buy (or solicitation of an offer to buy) any interests in the Fund in Japan.

Interests in the Fund are a security set forth in Article 2, Paragraph 2, Item 6 of the Financial Instruments and Exchange Law of Japan (the “FIEA”). No public offering of interests in the Fund is being made to investors resident in Japan and in accordance with Article 2, paragraph 3, Item 3, of the FIEA, no securities registration statement pursuant to Article 4, paragraph 1, of the FIEA has been made or will be made in respect to the offering of interests in the Fund in Japan. The offering of interests in the Fund in and investment management for the Fund in Japan is made as “Special Exempted Business for Qualified Institutional Investors, Etc.” under Article 63, Paragraph 1, of the FIEA. Thus, interests in the Fund are being offered only to certain investors in Japan. Neither the Fund nor any of its affiliates is or will be registered as a “financial instruments firm” pursuant to the FIEA. Neither the Financial Services Agency of Japan nor the Kanto Local Finance Bureau has passed upon the accuracy or adequacy of the Fund’s Offering Documents or otherwise approved or authorized the offering of interests in the Fund to investors resident in Japan.

As of April 2024, Capstone Fund Services, LLC (“CFS”) and Capstone Fund Services II, LLC (“CFS II”) each have submitted Notification Form for Specially Permitted Businesses for Qualified Institutional Investors, etc. to the Kanto Local Finance Bureau in accordance with the FIEA. Each CFS and CFS II are organized for the purpose of engaging in any and all activities permitted under applicable law, including providing, directly or indirectly through Affiliates or joint ventures, a full range of investment advisory and management services. In connection with the foregoing, each of CFS and CFS II may serve as general partner or managing member (or in a similar capacity) with respect to other vehicles in the future, as determined by their Managing Member. Neither of the aforementioned Funds nor any of its affiliates is or will be registered as a “Financial Instruments Business Operator” pursuant to the FIEA.

Notice to Investors in Korea: Capstone is not making any representation with respect to the eligibility of any recipients of this material to acquire any products managed by Capstone under the laws of Korea, including but without limitation the Foreign Exchange Transaction Act and Regulations thereunder. Capstone has not registered any shares with regards to any of its products under the Financial Investment Services and Capital Markets Act of Korea, and none of the shares may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in Korea or to any resident of Korea except pursuant to applicable laws and regulations of Korea.

Notice to Investors in Kuwait: This material has not been approved for distribution in the State of Kuwait by the Ministry of Commerce and Industry or the Central Bank of Kuwait or any other relevant Kuwaiti government agency. The distribution of this material is, therefore, restricted in accordance with law no. 31 of 1990 and law no. 7 of 2010, as amended. No private or public offering of securities is being made in the State of Kuwait, and no agreement relating to the sale of any securities will be concluded in the State of Kuwait. No marketing, solicitation or inducement activities are being used to offer or market securities in the State of Kuwait.

Notice to Investors in Russia: The securities (financial instruments) are not intended for placement in (or on the territory of) the Russian Federation and are not advertised or otherwise publicly marketed and/or offered for sale to the public in the Russian Federation. This confidential private placement memorandum is not subject to registration pursuant to Section 51.1 of the Russian Federal Law No. 39-FZ of April 22, 1996 (as amended) “on the Securities Market”.

Notice to Investors in Saudi Arabia: Capstone is not registered in any way by the Capital Market Authority or any other governmental authority in the Kingdom of Saudi Arabia. This presentation does not constitute and may not be used for the purpose of an offer or invitation

Notice to Investors in Singapore: This material has not been submitted to the Monetary Authority of Singapore. Accordingly, this material and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of shares may not be circulated or distributed, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor pursuant to Section 304 of the Securities and Futures Act, Chapter 289 of Singapore (the “SFA”)) or (ii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Notice to Investors in Switzerland: The offer and the marketing of the Fund’s Shares in Switzerland will be exclusively made to, and directed at, qualified investors (the “Qualified Investors”), as defined in Article 10(3) and (3ter) of the Swiss Collective Investment Schemes Act (“CISA”) and its implementing ordinance, at the exclusion of qualified investors with an opting-out pursuant to Art. 5(1) of the Swiss Federal Law on Financial Services (“FinSA”) and without any portfolio management or advisory relationship with a financial intermediary pursuant to Article 10(3ter) CISA (“Excluded Qualified Investors”). Accordingly, the fund has not been and will not be registered with the Swiss Financial Market Supervisory Authority (“FINMA”) and no representative or paying agent have been or will be appointed in Switzerland. This marketing materials, the Memorandum and/or any other offering or marketing materials relating to the Fund’s Shares may be made available in Switzerland solely to Qualified Investors, at the exclusion of Excluded Qualified Investors. The legal documents of the Fund may be obtained free of charge from [email protected].

Notice to Investors in UAE: Capstone has not received authorization or licensing from the Central Bank of the UAE, the SCA or any other authority in the UAE to market or sell interests within the UAE. Nothing contained in this presentation is intended to constitute UAE investment, legal, tax, accounting or other professional advice. This presentation is for the informational purposes only and nothing in this presentation is intended to endorse or recommend a particular course of action. Prospective investors should consult with an appropriate professional for specific advice rendered on the basis of their situation.