The Role of Volatility in Portfolio Completion

The global economy and financial markets are in constant flux. This volatility drives market dynamics. When fear drives markets, time speeds up and volatility rises, while during episodes of complacency, time and volatility slow down. Understanding the dynamics of volatility helps to uncover investor sentiment and expectations. The world of volatility has expanded over time and by now can be found everywhere within finance. This piece aims to demonstrate how volatility has evolved from being an input needed to calculate the price of an option toa central pivot point needed to navigate global markets.

Although realistically risk is multi-faceted, volatility has generally been widely accepted as the major yardstick for measuring risk. As a consequence, volatility plays a central role in all existing risk management practices, which implies that changes in volatility will automatically affect risk budgets and positioning. For example, central banks aim to stabilize economic fundamentals, inflation, and financial market behavior. By suppressing volatility, they are able to stimulate risk appetite. As oftentimes stability begets instability, too much complacency induced by these central banks “puts” can potentially lead to excessive risk taking and result in valuation extremes. A risk event can disturb this fragile balance and trigger a reversal in sentiment. Rising volatility can spur de-risking and drive investors toward capitulation. Risk management and volatility swings have a tendency to amplify cyclicality.

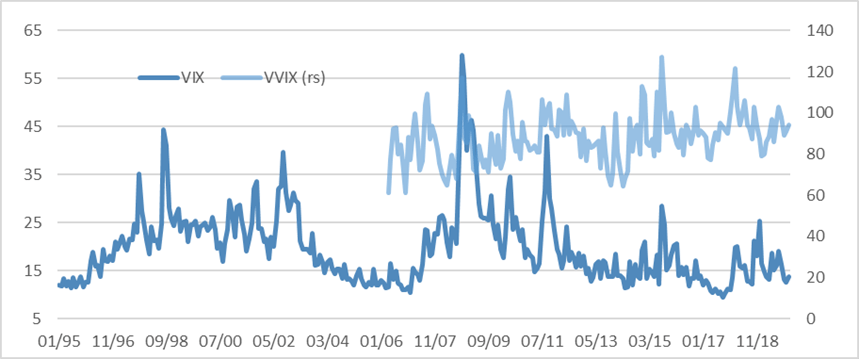

Understanding the role of volatility in portfolio construction and risk management has become more important than ever in our view. The adoption of volatility scaling has gained continuous prominence as risk based portfolio construction concepts, such as risk parity, became more widely accepted. The more embedded the use of volatility has become in markets, the more volatility became a force in itself. From a historical perspective, volatility levels have moderated, with 2017 as an example of how low the levels can get, but Capstone has also witnessed that volatility itself can become much more erratic. Chart 1 shows that S&P500 volatility has moderated, while the volatility of VIX has not.

Chart 1: VIX and Volatility of VIX

Source: Bloomberg and Capstone

Although S&P 500 volatility, measured by the VIX, in 2017 hit historical lows, the volatility of volatility, measured by VVIX, stayed elevated. In February 2018, the muted volatility regime abruptly ended with what the market now refers to as “Volmaggedon”, the capitulation event in crowded short volatility products. Using short-term volatility measures to scale exposures has the embedded risk of dialing up leverage when complacency and valuation levels are stretched. Knowing which volatility measures to use is therefore highly relevant.

When looking at volatility in the context of portfolio completion, it may be useful to distinguish four different perspectives:

- Capital Preservation

- Risk Premiums and Enhanced Beta

- Portfolio Efficiency

- Risk Insights

Capital Preservation

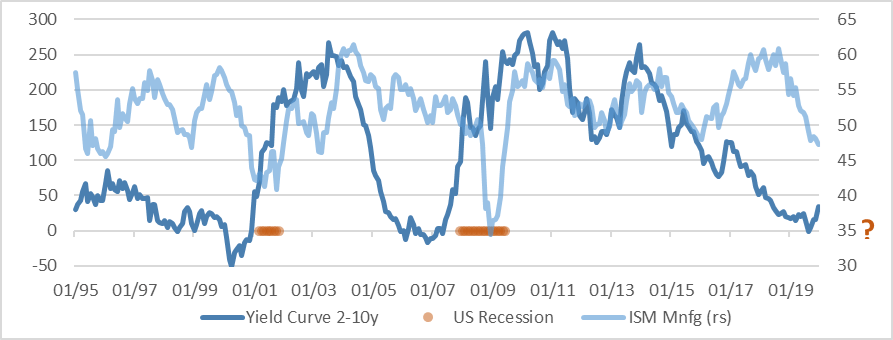

Currently there is a growing sense of urgency amongst investors to anticipate a turnaround or correction of the bull market that started more than a decade ago. Several leading indicators, like flat to inverted global yield curves and the US manufacturing index, give rise to expectations of a recession and/or an equity bear market on a 1 to 3 year horizon. Chart 2 shows that the current flatness of the US yield curve and the level of the ISM manufacturing survey are at levels comparable to the ones we have seen ahead of the 2001 and 2008 recessions.

Chart 2: Yield curve and leading indicator recession warnings

Source: Bloomberg and Capstone

Volatility expertise can help protect a portfolio against various risk scenarios through tailored tail hedges. These can be focused on an asset class, but can also be customized to improve capital or funding status preservation during episodes of stress. The focus will be on adding an overlay that is negatively correlated in bad times.

Risk Premiums and Enhanced Beta

Volatility can be seen as an alternative beta in itself and it can provide diversifying returns that are either non- or low-correlated. The volatility risk premium, or the difference between implied and realized volatility, which is also known as the price of fear, has become a popular alternative beta strategy. Long-term investors for instance can sell protection to more risk adverse market participants. However, by now, crowdedness and sometimes irresponsive management practices have created several independent volatility events, of which the most recent Volmageddon during February 2018 has had worldwide news coverage. Importantly, short volatility strategies will have a positive correlation to risk-on assets and have limited ability to diversify when it matters most. The approach to volatility of Capstone is balanced, by recognizing that volatility can be approached on a wide spectrum in between short and long volatility. There is typically a rich opportunity set that offers low to non-correlated returns, partly based on skill and complexity risk premiums. Examples are for instance extracted from dislocations, relative value opportunities, arbitrage and dispersion. Another way to benefit from volatility and derivative knowledge is to use volatility insights to attempt to create better betas, such as defensive equity with a focus on significant participation in the upside, while reducing tail event losses.

Portfolio Efficiency

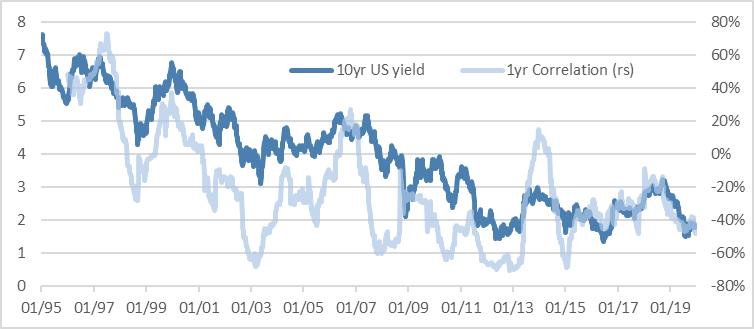

Capital-based portfolio implementation limits the scope to optimize its risk-return profile. For instance, a 60% allocation to equity typically implies that the equity factor drives about 90% of the portfolio from a risk perspective. For this reason, the concept of volatility scaling has become a widely used tool to balance portfolios as well as to scale trades and strategies. Risk parity investing, for example, uses this concept to seek to improve the allocation to asset classes and return drivers and to construct a more robust portfolio than can otherwise be accomplished by allocating capital. One unit of capital can have a quite different risk profile as compared to another asset class and volatility scaling can help to manage concentration risks. The success of risk parity has profited significantly from both the bull market in bonds and the drop to historically low to negative yields in many developed markets and the negative correlation between equities and bonds.

Chart 3: Risk parity tailwinds; ever lower yields and a negative equity-bond return correlation

Source: Bloomberg and Capstone

Disclaimers

The content of this document is confidential and proprietary and may not be reproduced or distributed, in whole or in part, without the express written permission of Capstone Investment Advisors, LLC (“Capstone”). The content herein is based upon information we deem reliable but there is no guarantee as to its reliability, which may alter some or all of the conclusions contained herein. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as investment advice. This document is not an offer or solicitation for the purchase or sale of any financial instrument, product or services sponsored or provided by Capstone. This document is not an advertisement and is not intended for public use or additional further distribution. By accepting receipt of this document the recipient will be deemed to represent that they possess, either individually or through their advisors, sufficient investment expertise to understand the risks involved in any purchase or sale of any financial instruments discussed herein. Neither this document nor any of its contents may be used for any purpose without the consent of Capstone.

The market commentary contained herein represents the subjective views of certain Capstone personnel and does not necessarily reflect the collective view of Capstone, or the investment strategy of any particular Capstone fund or account. Such views may be subject to change without notice. You should not rely on the information discussed herein in making any investment decision. Not investment research. The market data highlighted or discussed in this document has been selected to illustrate Capstone’s investment approach and/or market outlook and is not intended to represent fund performance or be an indicator for how funds have performed or may perform in the future. Each illustration discussed in this document has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. This document is not an offer to sell or the solicitation of any offer to buy securities. Capstone is not recommending any trade and cannot since it is not a broker-dealer. Nothing in this document shall constitute a recommendation or endorsement to buy or sell any security or other financial instrument referenced in this document.

Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice.

Reference to Instruments and Indices:

References to indices are included for illustrative purposes only and are not intended to apply that any Capstone fund or account is similar to such index in composition or element of risk.

The S&P 500® Index (SPX) consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value.

CBOE Volatility Index® (VIX® Index): The CBOE Volatility Index® (VIX® Index) is based on real-time prices of options on the S&P 500® Index (SPX) and is designed to reflect investors’ consensus view of future (30-day) expected stock market volatility.

Notice to Investors in Australia

Capstone regulated by the SEC under US laws, which differ from Australian laws. Capstone is exempt from the requirement to hold an Australian financial services license under the Australian Corporations Act in respect of the financial services that it provides.

Notice to Investors in Brazil

The Fund is not listed with any stock exchange, organized over the counter market or electronic system of securities trading. Interests in the Fund have not been and will not be registered with any securities exchange commission or other similar authority, including the Brazilian Securities and Exchange Commission (Comissão de valores Mobiliários – or the “CVM”). Interest in the Fund will not be directly or indirectly offered or sold within Brazil through any public offering, as determined by Brazilian law and by the rules issued by the CVM, including Law No. 6,385 (Dec. 7, 1976) and CVM Rule No. 400 (Dec. 29, 2003), as amended from time to time, or any other law or rules that may replace them in the future. Acts involving a public offering in Brazil, as defined under Brazilian laws and regulations and by the rules issued by the CVM, including Law No. 6,385 (Dec. 7, 1976) and CVM Rule No. 400 (Dec. 29, 2003), as amended from time to time, or any other law or rules that may replace them in the future, must not be performed without such prior registration. Persons in Brazil wishing to acquire interests in the Fund should consult with their own counsel as to the applicability of these registration requirements or any exemption therefrom. Without prejudice to the above, the sale and solicitation of interests in the Fund is limited to professional investors as defined by CVM Rule No. 539 (Nov. 13, 2013), as amended, or as defined by any other rule that may replace it in the future. This presentation is confidential and intended solely for the use of the addressee and cannot be delivered or disclosed in any manner whatsoever to any person or entity other than the addressee.

Notice to Investors in California

This information is confidential. If you are not the intended recipient, please delete it without further distribution and reply to the sender that you have received the message in error. This message is provided for information purposes and should not be construed as a solicitation or offer to buy or sell any securities or related financial instruments in any jurisdiction. California residents should review our

California Privacy Notice:

https://www.capstoneco.com/regulatory-disclosures/#california_consumer_privacy_act

Notice to Investors in China

Interests in the Fund may not be marketed, offered or sold directly or indirectly to the public in China and neither this marketing material, which has not been submitted to the Chinese Securities and Regulatory Commission, nor any offering material or information contained herein relating to interests in the Fund, may be supplied to the public in China or used in connection with any offer for the subscription or sale of interests in the Fund to the public in China. Interests in the Fund may only be marketed, offered or sold to Chinese institutions which are authorized to engage in foreign exchange business and offshore investment from outside China. Chinese investors may be subject to foreign exchange control approval and filing requirements under the relevant Chinese foreign exchange regulations, as well as offshore investment approval requirements.

Notice to Investors in Japan

No filings have been made with respect to any of Capstone’s funds in Japan and the strategy is currently not intended for investment by Japanese investors. Thus, we are not providing this material to you for purposes of soliciting an investment in fund securities by you or your client investors, but rather to illustrate the manner in which we would plan to manage an asset management mandate (structured in a mutually acceptable and compliant form) granted to us by you should you so elect. By accepting this material, you acknowledge, confirm and agree that you have never been contacted by a representative of the fund or its manager in any manner which may amount to an offer to buy (or solicitation of an offer to buy) any interests in the fund in Japan.

Interests in the Fund are a security set forth in Article 2, Paragraph 2, Item 6 of the Financial Instruments and Exchange Law of Japan (the “FIEA”). No public offering of interests in the Fund is being made to investors resident in Japan and in accordance with Article 2, paragraph 3, Item 3, of the FIEA, no securities registration statement pursuant to Article 4, paragraph 1, of the FIEA has been made or will be made in respect to the offering of interests in the Fund in Japan. [The offering of interests in the Fund in and investment management for the Fund in Japan is made as “Special Exempted Business for Qualified Institutional Investors, Etc.” under Article 63, Paragraph 1, of the FIEA. Thus, interests in the Fund are being offered only to certain investors in Japan.] Neither the Fund nor any of its affiliates is or will be registered as a “financial instruments firm” pursuant to the FIEA. Neither the Financial Services Agency of Japan nor the Kanto Local Finance Bureau has passed upon the accuracy or adequacy of this Memorandum or otherwise approved or authorized the offering of interests in the Fund to investors resident in Japan.

Notice to Investors in Switzerland

Notice to Investors in Switzerland: The offer and the marketing of the fund’s Shares in Switzerland will be exclusively made to, and directed at, qualified investors (the “Qualified Investors”), as defined in Article 10(3) and (3ter) of the Swiss Collective Investment Schemes Act (“CISA”) and its implementing ordinance, at the exclusion of qualified investors with an opting-out pursuant to Art. 5(1) of the Swiss Federal Law on Financial Services (“FinSA”) and without any portfolio management or advisory relationship with a financial intermediary pursuant to Article 10(3ter) CISA (“Excluded Qualified Investors”). Accordingly, the fund has not been and will not be registered with the Swiss Financial Market Supervisory Authority (“FINMA”) and no representative or paying agent have been or will be appointed in Switzerland. This marketing materials, the Memorandum and/or any other offering or marketing materials relating to the fund’s Shares may be made available in Switzerland solely to Qualified Investors, at the exclusion of Excluded Qualified Investors. The legal documents of the fund may be obtained free of charge from [email protected]