Monitoring the Value of Hedging

Introducing Capstone Hedge Horizon

The consensus is equity hedging is cheap, but just how cheap?

With the VIX dropping back to pre-COVID lows in 2024, there was much talk about how ‘cheap’ it is for investors to protect equity portfolios. But just how cheap? And even if hedging is cheap, is it cheap enough to be worthwhile? In an effort to apply some quantitative rigor, we introduce the Capstone Hedge Horizon metric as a way for investors to assess the relative attractiveness of hedge prices over time. Under this metric we find that some hedge costs have recently been at their cheapest for nearly ten years, and that taking an active approach to hedging can significantly improve cost-effectiveness.

Buy Your Umbrella When the Sun is Shining! Hedging Favors Contrarians

After another exceptional year of stock performance in 2024 and despite the turbulence earlier in 2025, equity investors are riding high. At times like these, many find it easy to ignore the risk of a pull-back, but periods of broader complacency are exactly when investors should look to protect gains. Insurance costs typically move inversely to stock prices, and the current market is no exception, with hedge premiums dropping to levels not seen since before the Global Financial Crisis of 2008. The smart decision therefore must be to hedge – but is hedging cheap enough to be worth the outlay? To quantify the potential benefit, we use the concept of breakevens to show investors how often a hedge needs to pay out for it to be worthwhile to hold.

Measuring Hedge Effectiveness – Calculating Years-to-Breakeven

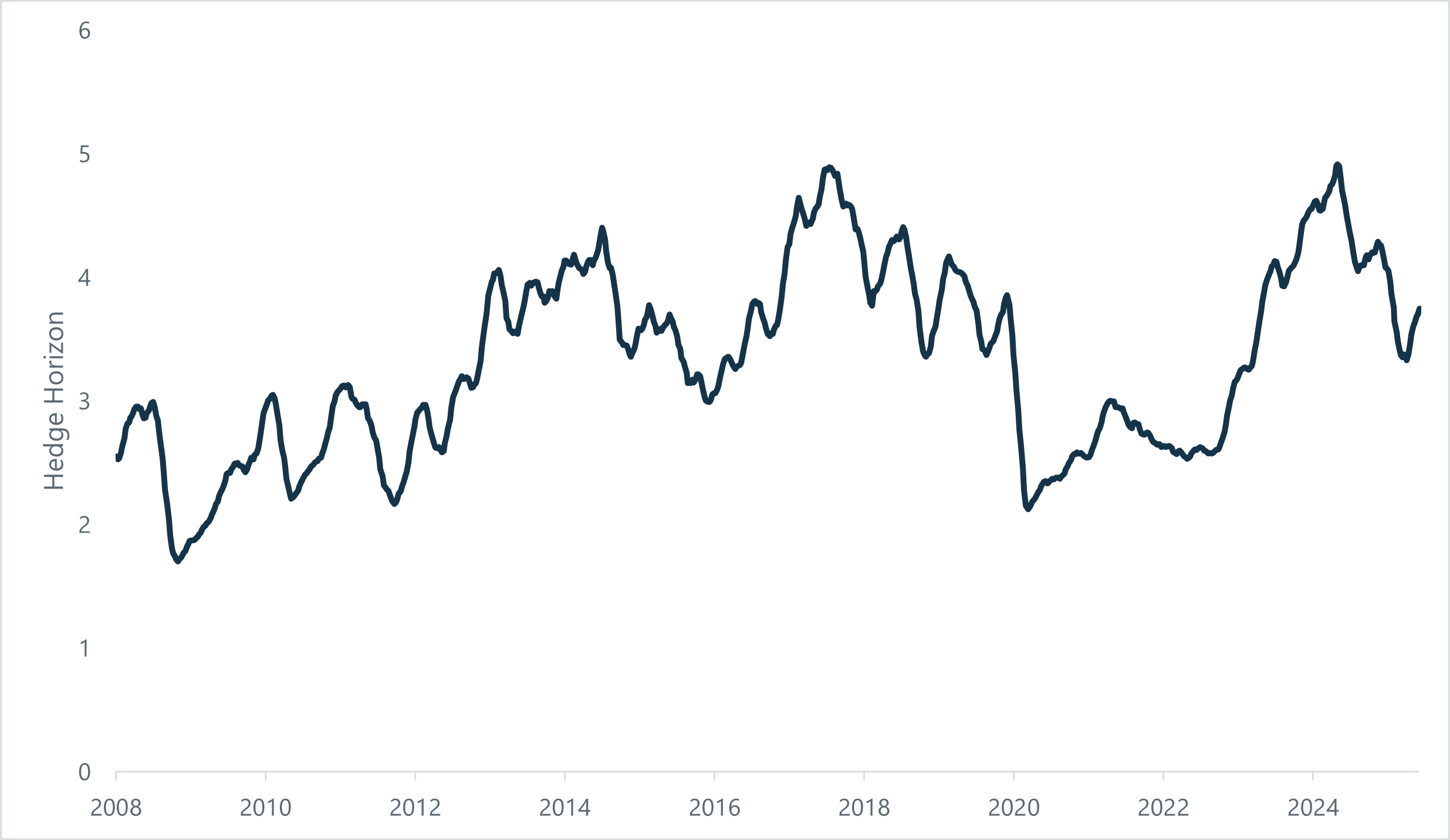

Consider a one-year maturity 90%-strike put option on the S&P 500 – for a fixed cost up front (currently around 2.5% of equity value being protected in September 2025), investors are protected against any equity falls of more than 10% at the end of the year. How do we assess whether the option cost is good value? To quantity the cost/benefit, we look at a breakeven analysis – how much does the option pay out for given market shocks, and how often do those drawdowns have to occur to recoup the outlay of purchasing the protection? We define a metric we call ‘Hedge Horizon’ that takes in the cost of a hedge, the payout of that hedge in different stress scenarios (ranging between 20% to 40% market crashes), and the relative frequency of those drawdowns. Figure 1 shows the historical Hedge Horizon for the one-year 90%-strike put. Interpreting the chart, the current reading shows that one would need a crash in the S&P 500 Index of at least 20% every four years for a hedge to be profitable.

Figure 1: Historical Hedge Horizon for 1-Year 90%-Strike S&P 500 Index Put Option

Source: Capstone, Bloomberg.

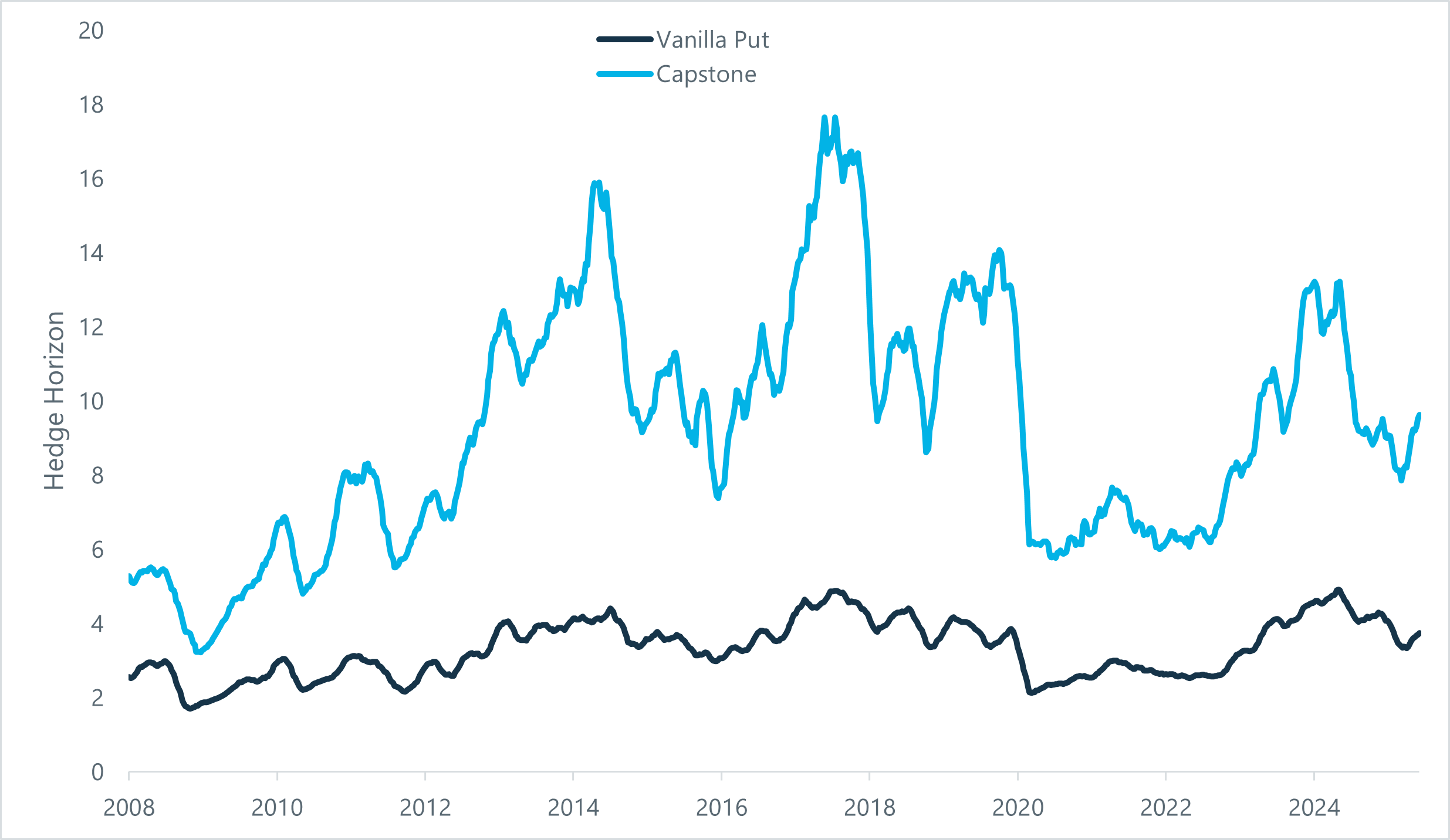

The Value of a Specialist Manager

As a volatility specialist, Capstone believes it is possible to design protection strategies that are significantly more effective than vanilla put options. By tailoring a hedge to cost less and to provide greater pay-off in times of market stress, one can significantly increase the potential benefit. Figure 2 compares the Hedge Horizon calculated for a vanilla hedging strategy to that of a broader and actively managed tail hedging strategy – the current metric jumps from just under four years to nearly ten, with historical peaks greater than fifteen years, highlighting the value of a specialist hedge manager.

Figure 2: Hedge Horizon for Vanilla Hedge and Diversified Actively Managed Tail Hedge

Source: Capstone, Bloomberg.

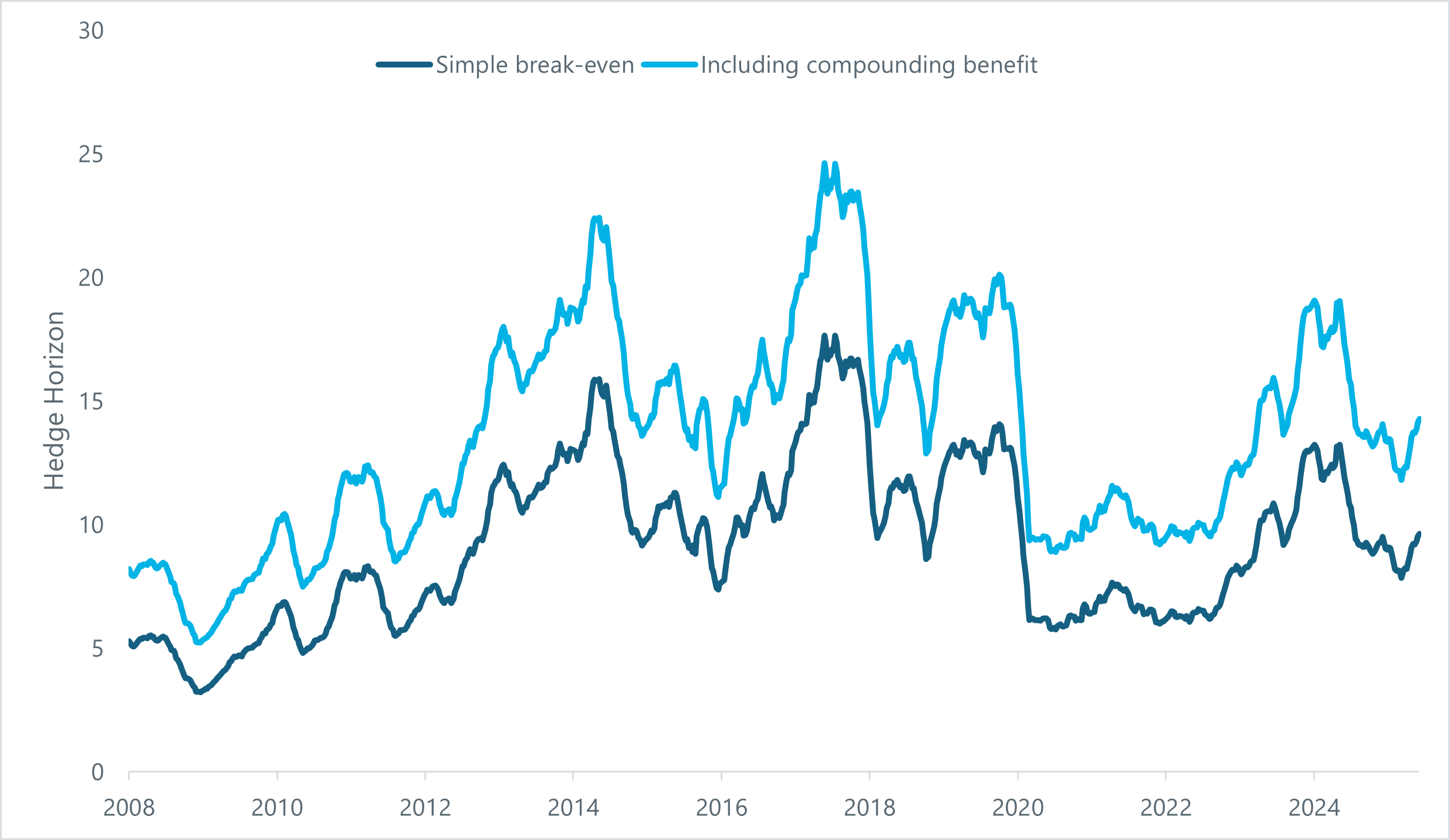

Added Benefits – Protecting Compounded Growth

A simple breakeven calculation provides a useful tool for assessing the value of hedging, but there is a further benefit to consider. The power of hedging is in protecting long-term portfolio growth – earning back losses is significantly harder than making gains, and so avoiding drawdowns is critical. Figure 3 illustrates the extra benefit from return compounding – reducing portfolio volatility in this way makes hedging even more cost-effective, currently adding nearly five years of extra runway for a hedge to be profitable.

Figure 3: Simple Breakevens vs Including Compounding Benefit1

Source: Capstone, Bloomberg.

‘Cheap Enough’ Depends on Market Outlook

Low headline levels of volatility entice investors to look at hedging. Breakeven analysis can help more concretely assess whether costs are appealing relative to an investor’s market outlook. By defining our Hedge Horizon metric, we show that vanilla equity hedging is now near its cheapest for ten years, while Capstone’s flagship tail hedging strategy can offer more than double the potential benefit of vanilla hedging. Rather than simply claiming that hedging is cheap, an investor using these tools can more effectively quantify whether it is cheap enough.

1Assuming 1% allocation to tail hedging, average 11.2% equity market return when not in a stress event.

Disclaimers

The content of this document is confidential and proprietary and may not be reproduced or distributed, in whole or in part, without the express written permission of Capstone Investment Advisors, LLC (“Capstone”). This document reflects the opinions of Capstone and is not an offer to sell or the solicitation of any offer to buy securities. The content herein is based upon information we deem reliable but there is no guarantee as to its reliability, which may alter some or all of the conclusions contained herein. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as investment advice. This document is not an offer or solicitation for the purchase or sale of any financial instrument, product or services sponsored or provided by Capstone. This document is not an advertisement and is not intended for public use or additional further distribution. By accepting receipt of this document the recipient will be deemed to represent that they possess, either individually or through their advisors, sufficient investment expertise to understand the risks involved in any purchase or sale of any financial instruments discussed herein. Neither this document nor any of its contents may be used for any purpose without the consent of Capstone.

The market commentary contained herein represents the subjective views of certain Capstone personnel and does not necessarily reflect the collective view of Capstone, or the investment strategy of any particular Capstone fund or account. Such views may be subject to change without notice. You should not rely on the information discussed herein in making any investment decision. Not investment research. The market data highlighted or discussed in this document has been selected to illustrate Capstone’s investment approach and/or market outlook and is not intended to represent fund performance or be an indicator for how funds have performed or may perform in the future. Each illustration discussed in this document has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. This document is not an offer to sell or the solicitation of any offer to buy securities. The content herein is based upon information we deem reliable but there is no guarantee as to its reliability, which may alter some or all of the conclusions contained herein. This document may not be reproduced or distributed without the express written permission of Capstone.

References to indices are included for illustrative purposes only and are not intended to apply that any Capstone fund or account is similar to such index in composition or element of risk.

CBOE Volatility Index (VIX Index): The CBOE Volatility Index (VIX Index) is based on real-time prices of options on the S&P 500® Index (SPX) and is designed to reflect investors’ consensus view of future (30-day) expected stock market volatility.

The S&P 500 Index (SPX) consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value.

Hypothetical Backtested Performance Disclaimer: This document includes hypothetical backtested returns, which were prepared by Capstone, for Capstone’s flagship tail hedging strategy, called Capstone Portfolio Protection (“CPP”). CPP is rebalanced annually and profits or losses are reinvested into the components. Returns are adjusted for exposure and fees. Returns are net of 1.50% fees on AUM. Returns do not include monetization. The optimal premium spend selection is Capstone’s opinion. At the time of the rebalance, any amounts above (below) the capital and premium requirements are reinvested in (divested from) the client portfolio holdings. Performance of the CPP overlay is sensitive to the exact rebalance cycle. With CPP, it is generally ensured that the premium spent is a constant fraction of notional hedged. In a rising market, CPP is generally expected to have negative returns, and as such, the CPP asset base depletes and will no longer be 1.00% relative to the client portfolio notional. In any practical implementation of CPP, capital could be deployed to and from CPP at any time. Opinions and estimates may be changed without notice and involve a number of assumptions which may not prove valid. There is no guarantee that any program can achieve its targets, including the reduction of annual bleed.

Results for Convex CPP include hypothetical backtested results. Backtested returns for Convex CPP are shown for the period of January 04, 1999 through April 13, 2010. The Convex CPP backtest uses 6 strategies, including SPX variance, SPX options on variance, VIX calls, NDX puts, and SPX convexity. From April 14, 2010 through November 30, 2010, the performance for Convex CPP is based solely on a live paper portfolio on behalf of a large insurance company, whilst no other paper portfolio was run during this time. From December 2010 until July 1, 2013, the paper portfolio transitioned into a fully live mandate and performance is shown for a managed account for the aforementioned insurance company, whilst there were no other accounts being managed during this period. Thereafter, performance is shown is the average performance of live Convex CPP funds. The operating expenses incurred and applied to each of these funds/accounts and the hypothetical account are different.

Backtests do not use any active management. Strategies are run until expiry and replaced with the same strategy. Backtested results do not account for bid/offer spreads, although this impact on portfolio performance is expected to be small. Backtested results assume that no interest is earned on any cash balances. While the backtest does not hold all capital in cash, a positive cash balance is generally expected to remain. Cash purchases and mark-to-market losses are subtracted from the cash balance. Added to the cash balance are gains resulting from in-the-money puts, for instance, and positive marks-to-market. Any practical implementation of the strategy would account for any interest income that is received.

Sources of data are Bloomberg and Capstone. Statistics use monthly data. The pricing of instruments underlying ‘listed’ strategies is obtained from Bloomberg and/or Option Metrics. Strategies that employ OTC instruments are valued using the volatility surfaces derived from listed options as provided by Bloomberg and/or Option Metrics depending on the instrument, availability of data, and corresponding applicable pricing source. CPP returns used in the hypothetical backtest performed well in prior stress events, such as the 2008 Financial Crisis and the 2020 COVID-19 Crisis, as demonstrated by the backtest. There is no guarantee that future events will unfold as these prior events did and that the CPP will perform as well. Future events may be less volatile, slower, or the volatility market may react differently, making CPP less effective or profitable. Other strategies or investments may prove to be better protectors of capital. Additionally, the future bleed of the CPP displayed herein may prove to be higher than the backtested experience.

General Risks of Hypothetical Backtested Performance: The performance presented herein does not represent the results of actual trading using client assets but were achieved by means of the retroactive application of a model. The hypothetical backtested performance was compiled after the end of the period depicted and does not represent the actual investment decisions of Capstone. Hypothetical backtested performance results have many inherent limitations, some of which are described below. No representation is being made that any account managed by Capstone will, or is likely to, achieve profits or losses similar to those shown. The hypothetical backtested performance presented herein has been provided to you on the understanding that, as a sophisticated investor, you understand and accept the inherent limitations of such illustrations and you will not rely on them in making any investment decision. Please contact Capstone if you would like to review the formulae utilized in calculating the hypothetical backtested performance that you can apply your own assumptions. Backtested performance should not be considered indicative of the skill of the adviser.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

THESE SECURITIES SHALL NOT BE OFFERED OR SOLD IN ANY JURISDICTION IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL UNTIL THE REQUIREMENTS OF THE LAWS OF SUCH JURISDICTION HAVE BEEN SATISFIED.

Notice to Investors in California: This information is confidential. If you are not the intended recipient, please delete it without further distribution and reply to the sender that you have received the message in error. This message is provided for information purposes and should not be construed as a solicitation or offer to buy or sell any securities or related financial instruments in any jurisdiction. California residents should review Capstone’s California Privacy Notice: : https://www.capstoneco.com/regulatory-disclosures/#california_consumer_privacy_act.

Notices to Investors Outside of the U.S.: Capstone is not registered, authorized or eligible for an exemption from registration in all jurisdictions. Therefore, services described in these materials may not be available in certain jurisdictions. These materials do not constitute an offer or solicitation where such actions are not authorized or lawful, and in some cases may only be provided at the initiative of the prospective investor. Further limitations on the availability of products or services described may be imposed. These materials are only intended for investors that meet qualifications as institutional investors as defined in the applicable jurisdiction where materials are received.

Notice to Investors in Australia: Capstone is regulated by the SEC under US laws, which differ from Australian laws. This material provided to you is factual in nature. It is not an offer or advice, and is not intended to recommend or state an opinion of Capstone. This document in its entirety is prepared by Capstone Investment Advisors, LLC (“Capstone”), a corporate authorized representative (number 1279754) of SILC Fiduciary Solutions Pty Ltd ACN 638 984 602 (AFSL 522145). The authority of Capstone is limited to providing general financial product advice to wholesale clients. Investors should seek independent financial advice before making any investment decisions.

Before acting on any advice or information in this document you should consider, with or without the assistance of suitable expert advice, whether it is appropriate for your circumstances. To the maximum extent permitted by law, SILC, Capstone and their directors and officers disclaim all liability or responsibility whatsoever for any direct or indirect loss or damage of any kind which may be suffered by any person through relying on anything contained or omitted from this document, caused by viruses or faults contained in this document or otherwise arising out of the use of any part of the information contained in this document.

Notice to Investors in Canada: The content of these materials has not been reviewed by any Canadian Securities Regulatory Authority and does not constitute an offer to sell or a solicitation of an offer to buy securities in any jurisdiction where such offer or solicitation would be unlawful, and such content does not constitute an offer to sell or a solicitation of an offer to buy or an advertisement in respect of securities in any province or territory of Canada.

Notice to Investors in China: These materials, which have not been submitted to the Chinese Securities and Regulatory Commission, may not be supplied to the public in China or used in connection with any offer for the subscription or sale of interests in any investment product to the public in China.

Notice to Investors in the European Union and United Kingdom: These materials are only intended for investors that meet qualifications as institutional investors as defined in the applicable jurisdiction where materials are received, which includes only Professional Investors as defined by the Markets in Financial Instruments Directive (MiFID). These materials are not for use by retail clients and may not be reproduced or distributed without Capstone’s permission.

Notice to Investors in Hong Kong: Warning: The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the document. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

Notice to Investors in Japan: No filings have been made with respect to any of Capstone’s funds in Japan and the strategy is currently not intended for investment by Japanese investors. Thus, we are not providing this material to you for purposes of soliciting an investment in fund securities by you or your client investors, but rather to illustrate the manner in which we would plan to manage an asset management mandate (structured in a mutually acceptable and compliant form) granted to us by you should you so elect. By accepting this material, you acknowledge, confirm and agree that you have never been contacted by a representative of the fund or its manager in any manner which may amount to an offer to buy (or solicitation of an offer to buy) any interests in the fund in Japan.

Interests in the fund are a security set forth in Article 2, Paragraph 2, Item 6 of the Financial Instruments and Exchange Law of Japan (the “FIEA”). No public offering of interests in the fund is being made to investors resident in Japan and in accordance with Article 2, paragraph 3, Item 3, of the FIEA, no securities registration statement pursuant to Article 4, paragraph 1, of the FIEA has been made or will be made in respect to the offering of interests in the fund in Japan. The offering of interests in the fund in and investment management for the fund in Japan is made as “Special Exempted Business for Qualified Institutional Investors, Etc.” under Article 63, Paragraph 1, of the FIEA. Thus, interests in the fund are being offered only to certain investors in Japan. Neither the Fund nor any of its affiliates is or will be registered as a “financial instruments firm” pursuant to the FIEA. Neither the Financial Services Agency of Japan nor the Kanto Local Finance Bureau has passed upon the accuracy or adequacy of the Fund’s Offering Documents or otherwise approved or authorized the offering of interests in the fund to investors resident in Japan.

As of April 2024, Capstone Fund Services, LLC (“CFS”) and Capstone Fund Services II, LLC (“CFS II”) each have submitted Notification Form for Specially Permitted Businesses for Qualified Institutional Investors, etc. to the Kanto Local Finance Bureau in accordance with the FIEA. Each CFS and CFS II are organized for the purpose of engaging in any and all activities permitted under applicable law, including providing, directly or indirectly through Affiliates or joint ventures, a full range of investment advisory and management services. In connection with the foregoing, each of CFS and CFS II may serve as general partner or managing member (or in a similar capacity) with respect to other vehicles in the future, as determined by their Managing Member. Neither of the aforementioned funds nor any of its affiliates is or will be registered as a “Financial Instruments Business Operator” pursuant to the FIEA.

Notice to Investors in Korea: Capstone is not making any representation with respect to the eligibility of any recipients of this material to acquire any products managed by Capstone under the laws of Korea, including but without limitation the Foreign Exchange Transaction Act and Regulations thereunder. Capstone has not registered any shares with regards to any of its products under the Financial Investment Services and Capital Markets Act of Korea, and none of the shares may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in Korea or to any resident of Korea except pursuant to applicable laws and regulations of Korea.

Notice to Investors in Kuwait: This material has not been approved for distribution in the State of Kuwait by the Ministry of Commerce and Industry or the Central Bank of Kuwait or any other relevant Kuwaiti government agency. The distribution of this material is, therefore, restricted in accordance with law no. 31 of 1990 and law no. 7 of 2010, as amended. No private or public offering of securities is being made in the State of Kuwait, and no agreement relating to the sale of any securities will be concluded in the State of Kuwait. No marketing, solicitation or inducement activities are being used to offer or market securities in the State of Kuwait.

Notice to Investors in Russia: The securities (financial instruments) are not intended for placement in (or on the territory of) the Russian Federation and are not advertised or otherwise publicly marketed and/or offered for sale to the public in the Russian Federation. This confidential private placement memorandum is not subject to registration pursuant to Section 51.1 of the Russian Federal Law No. 39-FZ of April 22, 1996 (as amended) “on the Securities Market”.

Notice to Investors in Saudi Arabia: Capstone is not registered in any way by the Capital Market Authority or any other governmental authority in the Kingdom of Saudi Arabia. This presentation does not constitute and may not be used for the purpose of an offer or invitation

Notice to Investors in Singapore: This material has not been submitted to the Monetary Authority of Singapore. Accordingly, this material and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of shares may not be circulated or distributed, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor pursuant to Section 304 of the Securities and Futures Act, Chapter 289 of Singapore (the “SFA”)) or (ii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Notice to Investors in Switzerland: The offer and the marketing of the fund’s Shares in Switzerland will be exclusively made to, and directed at, qualified investors (the “Qualified Investors”), as defined in Article 10(3) and (3ter) of the Swiss Collective Investment Schemes Act (“CISA”) and its implementing ordinance, at the exclusion of qualified investors with an opting-out pursuant to Art. 5(1) of the Swiss Federal Law on Financial Services (“FinSA”) and without any portfolio management or advisory relationship with a financial intermediary pursuant to Article 10(3ter) CISA (“Excluded Qualified Investors”). Accordingly, the fund has not been and will not be registered with the Swiss Financial Market Supervisory Authority (“FINMA”) and no representative or paying agent have been or will be appointed in Switzerland. This marketing materials, the Memorandum and/or any other offering or marketing materials relating to the fund’s Shares may be made available in Switzerland solely to Qualified Investors, at the exclusion of Excluded Qualified Investors. The legal documents of the fund may be obtained free of charge from [email protected].

Notice to Investors in UAE: Capstone has not received authorization or licensing from the Central Bank of the UAE, the SCA or any other authority in the UAE to market or sell interests within the UAE. Nothing contained in this presentation is intended to constitute UAE investment, legal, tax, accounting or other professional advice. This presentation is for the informational purposes only and nothing in this presentation is intended to endorse or recommend a particular course of action. Prospective investors should consult with an appropriate professional for specific advice rendered on the basis of their situation.