From Hero to Villain Is There a Problem with Trend-Following?

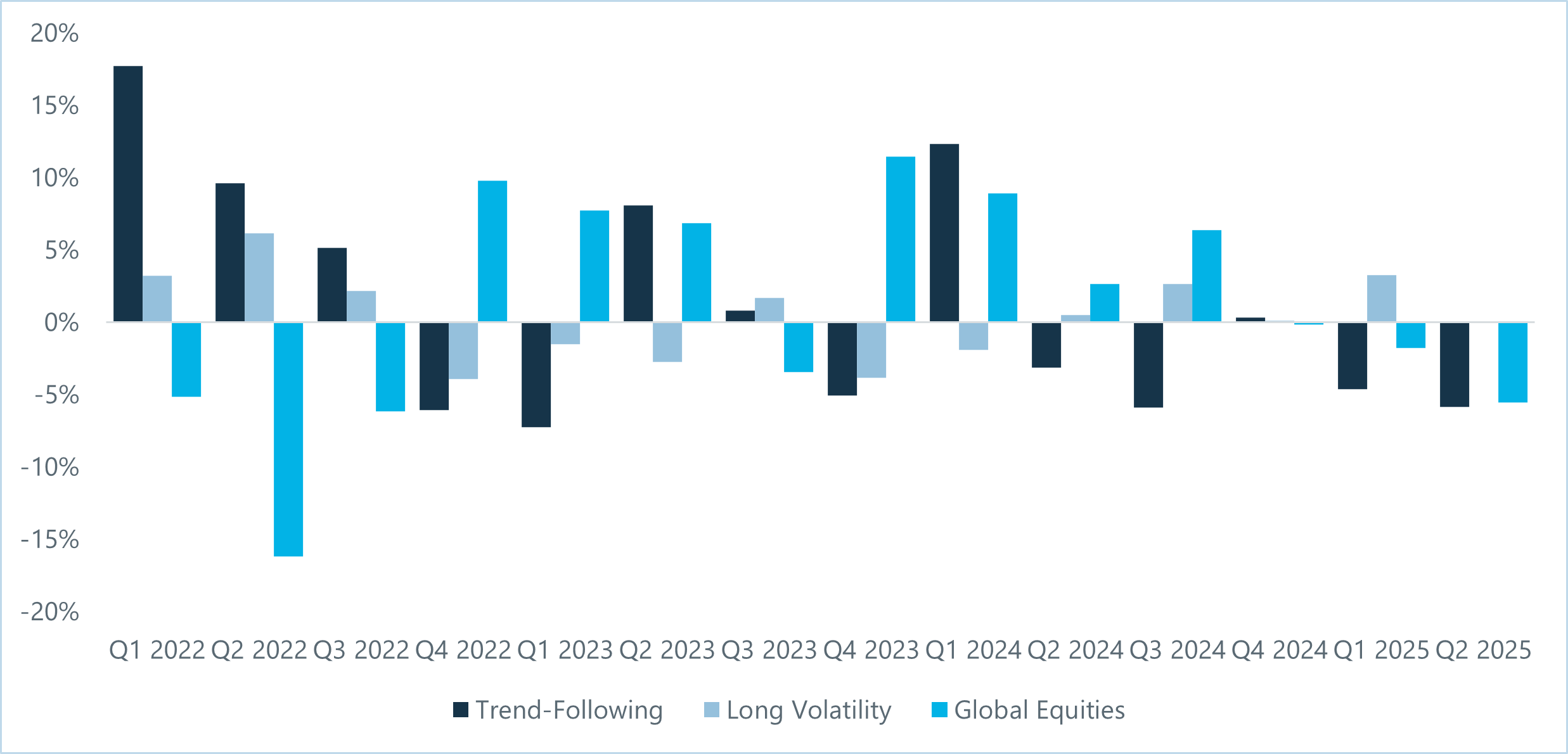

It has been only two years since the portfolio-saving contributions of trend-following, but the strategy is back in the crosshairs with investors frustrated at its recent failure to diversify. With equity markets falling sharply into correction territory in 2025, the lack of response from CTAs, following poor performance in 2023 and 2024, is threatening to undo the work done by asset allocators to integrate the strategy into institutional portfolios.

Did 2022 Overpromise?

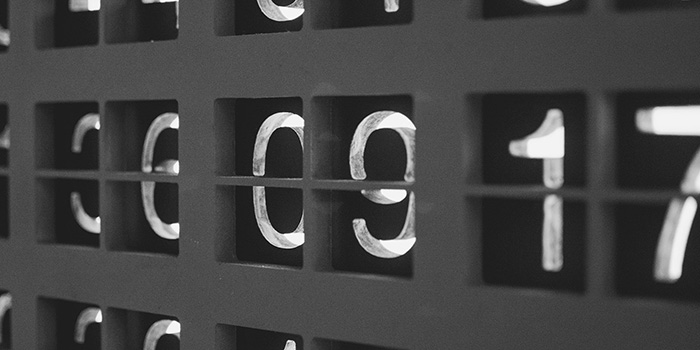

2022 was heralded as the start of a new era for trend-following. Long touted as a portfolio diversifier, the strategy delivered on its promise in a year that generally saw traditional 60/40 portfolios lose almost a fifth in value. The Société Générale Trend Index, a flagship representation of CTA industry performance, rose 27%, signalling strong outperformance for investors who had allocated to trend-following as a risk mitigating strategy. However, in the following two years, equities roared upwards, with trend-following flat or down. On the surface, one would think investors should be satisfied as they did not need a risk offset, but the path of recent trend-following returns is causing concern among some investors.

Questions were first raised by the sudden drawdown in response to the SVB Crisis in March 2023, where trend-followers were first wrongfooted and then locked in a meaningful portion of their losses near the lows. After spending 2023 recouping these losses, the correlation between trend-following and growth assets turned sharply positive in 2024 as the strategy was repeatedly hurt by both sudden pockets of equity weakness and a renewed sell-off in yields. The start to 2025 has been even worse, with trend-following delivering negative returns alongside an equity correction that has increased in severity through the year. As a result, some investors are beginning to question whether trend can provide the required protection in the current market environment.

Figure 1: Quarterly Trend-Following Performance vs Global Equities

Source: Capstone, Bloomberg. Trend-Following refers to Société Générale Trend Index, Global Equities to MSCI World Developed Index. Past performance is not a reliable indicator of future performance.

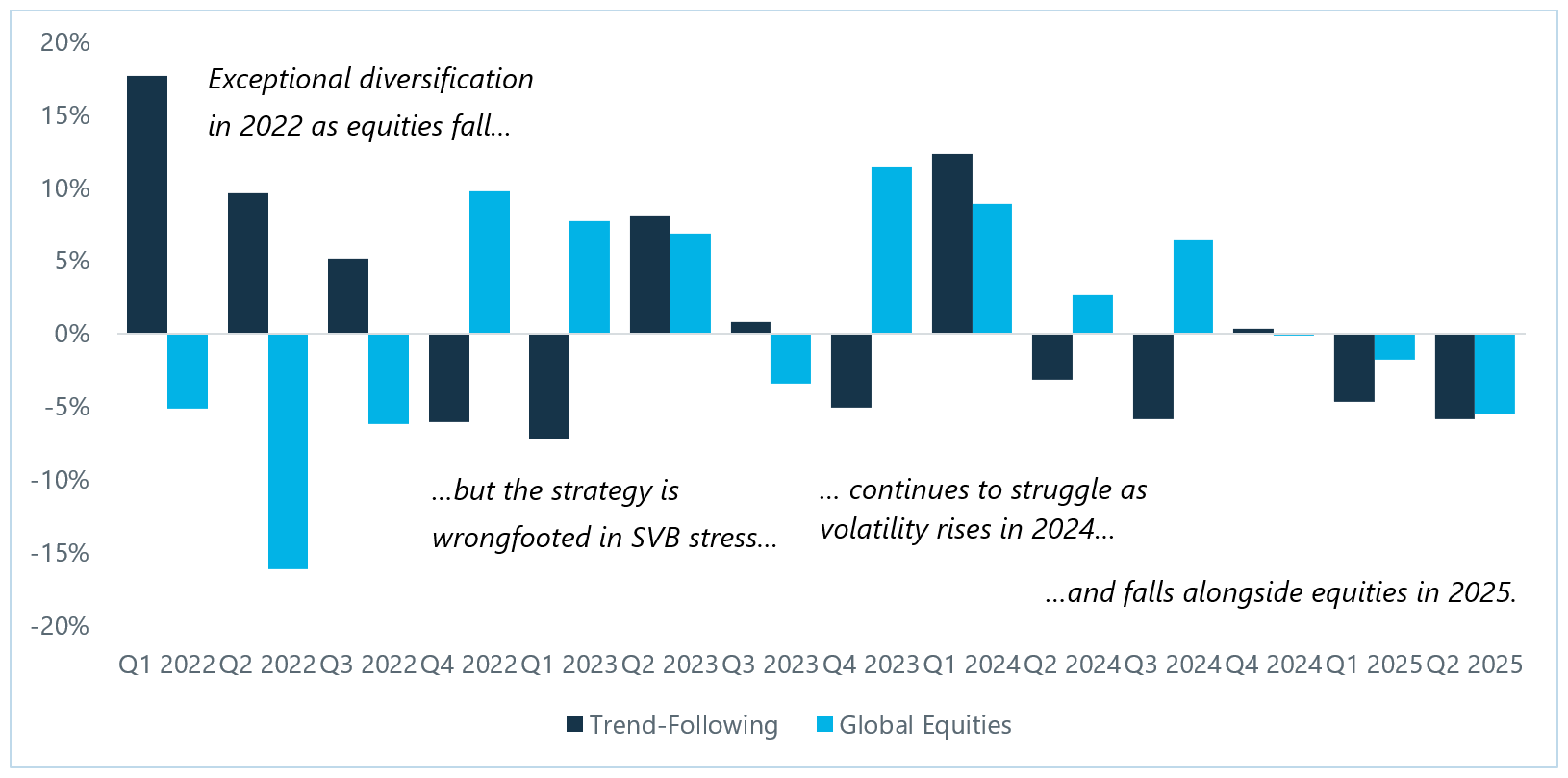

We’ve Been Here Before

Delivering broadly flat performance in two years where equities have delivered double digit returns might seem fair for a strategy that aims to provide its strongest returns when markets are struggling. Negative performance in 2025 seems more concerning, but investors have experienced periods like this before, where trend-followers suffered in oscillating markets. Figure 2 shows the historical drawdowns of trend-following and to equities, but more importantly also highlights the performance of trend-following during equity drawdowns. While the strategy has historically performed strongly during severe equity stress, there are several periods where trend has fallen alongside sudden equity drops.

Figure 2: Trend-Following Historical Performance vs Equities

Source: Capstone, Bloomberg. Equity drawdowns refer to Global Equities performance through MSCI World Developed Index, trend-following drawdowns to \Trend-Following performance through Société Générale Trend Index trend-following return of the Société Générale Trend Index during drawdowns in MSCI World Developed Index. Past performance is not a reliable indicator of future performance.

Despite the potentially reassuring historical context, there is no doubt that markets are moving faster than ever, and investors are worried about the lack of short-term reactivity from trend-following. The question is whether the strategy needs reconsidering altogether or whether there are other strategies that can complement and provide cover for situations where trend-following struggles.

What can investors do?

When investors express their concerns about the state of the current market, often what they are worried about is volatility. The VIX Index, a widely monitored indicator of investor risk perception, touched pre-Covid lows in mid-2024 as markets rallied to record highs, but in August 2024, the measure jumped sharply and has remained more elevated since.

In such an environment, hedge fund strategies that trade volatility directly are generally likely to benefit. Since markets first showed weakness in August 2024, the Eurekahedge Long Volatility Index (a benchmark of defensive volatility trading managers) has delivered positive monthly returns in all negative months for global equities. That contrasts with trend-following returns, which have been significantly negative in all but one of the months where equities have fallen. By reacting quicker in fast-moving markets, long volatility strategies can provide additional portfolio diversification alongside trend-following. Note, however, that trend still delivered stronger performance in 2022 where markets moved strongly lower over a longer window without a corresponding spike in volatility, demonstrating the potential benefit of combining the two strategies for such scenarios.

Figure 3: Comparison of Long Volatility and Trend-Following Strategies

Source: Capstone, Bloomberg. Trend-Following refers to Société Générale Trend Index, Long Volatility to Eurekahedge Long Volatility Index, and Global Equities to MSCI World Developed Index. Past performance is not a reliable indicator of future performance.

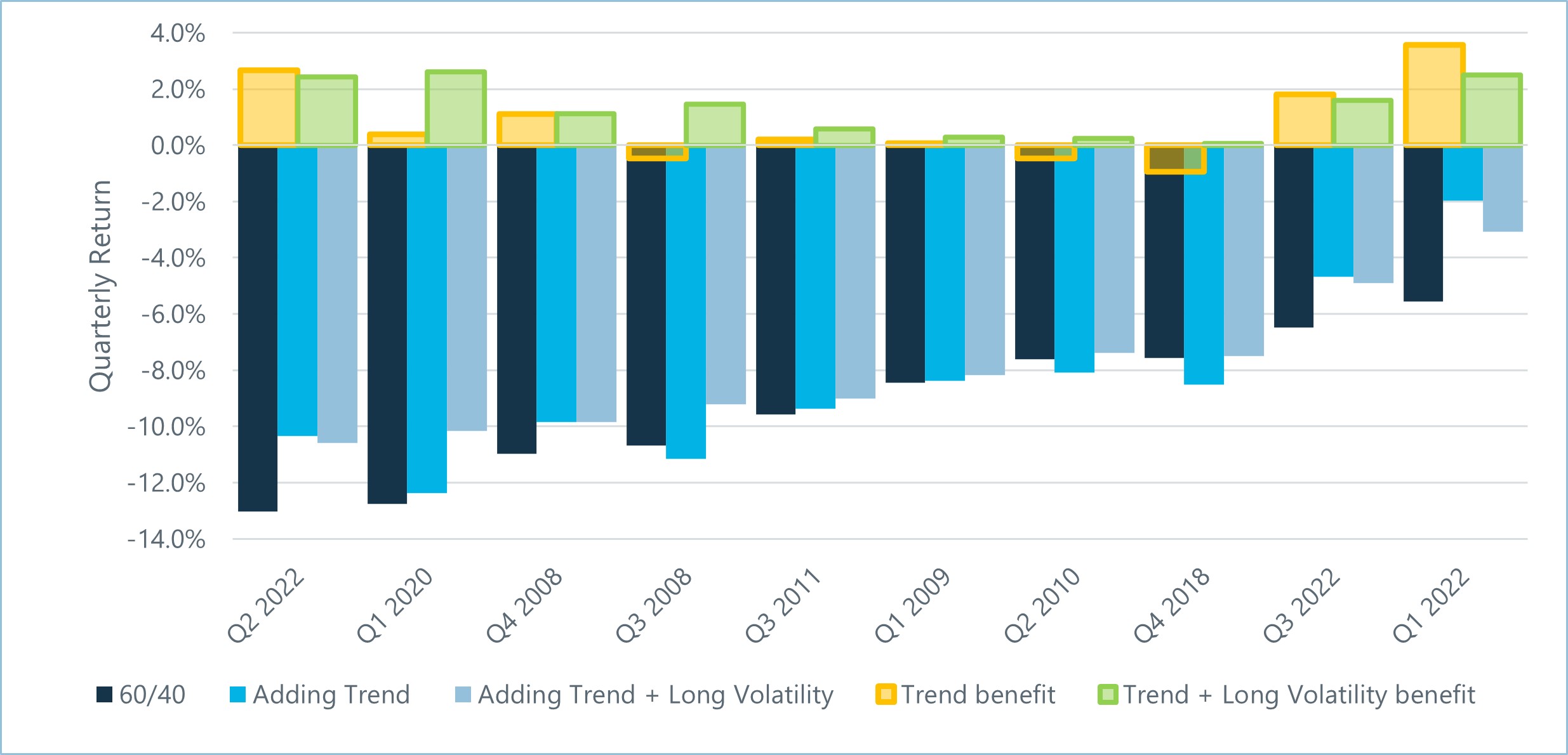

Looking further back in time, we can see the impact of diversifying a risk-mitigating allocation between trend-following and long volatility. Figure 4 looks at the performance of a 60/40 portfolio in its ten worst quarters since 2005 – the yellow bars show the benefit of diversifying into trend-following, and the green bars the benefit of blending trend-following with long volatility. While trend-following itself would have improved performance in the majority of cases, the addition of long volatility means drawdowns would have been reduced every time. In markets where volatility is elevated such as 2008, 2011, 2020, and so far in 2025, an allocation to long volatility is beneficial. By contrast when markets rise or fall strongly such as 2022, trend-following has historically participated and tended to outperform. This may suggest that investors should maintain their trend allocation as they add long volatility as a supplement. For those concerned about giving up long-term positive returns from trend-following, a broader range of volatility-related trading strategies may provide an effective alternative alongside long volatility. As always, there is no one-size-fits-all allocation, but the trade-offs are clear, and diversification of return drivers is usually key.

Figure 4: Impact of Splitting Defensive Allocation Between Trend-Following and Long Volatility

Source: Capstone, Bloomberg. The 60/40 portfolio refers to a 60% allocation to Global Equities and 40% to Global Bonds. Adding Trend assumes an allocation to the Société Générale Trend Index, while Adding Long Volatility refers to an allocation to the Eurekahedge Long Volatility Index. The respective benefit of adding trend and long volatility refers to the difference in returns on the combined portfolio relative to the 60/40 portfolio. Past performance is not a reliable indicator of future performance.

A Balanced Conclusion – Evolution Not Revolution

In an environment where volatility is elevated and markets move quickly, recent performance has been a reminder that trend-following will generally struggle. History suggests trend-following still merits a place in a risk mitigating portfolio, but by evolving the allocation to combine trend-following with long volatility, investors may be more likely to achieve the protection they seek.

Disclaimers

The content herein is based upon information we deem reliable but there is no guarantee as to its reliability, which may alter some or all of the conclusions contained herein. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as investment advice. This document is not an offer or solicitation for the purchase or sale of any financial instrument, product or services sponsored or provided by Capstone. This document is not an advertisement and is not intended for additional further distribution. By accepting receipt of this document the recipient will be deemed to represent that they possess, either individually or through their advisors, sufficient investment expertise to understand the risks involved in any purchase or sale of any financial instruments discussed herein. Neither this document nor any of its contents may be used for any purpose without the consent of Capstone.

The market commentary contained herein represents the subjective views of certain Capstone personnel and does not necessarily reflect the collective view of Capstone, or the investment strategy of any particular Capstone fund or account. Such views may be subject to change without notice. You should not rely on the information discussed herein in making any investment decision. Not investment research. The market data highlighted or discussed in this document has been selected to illustrate Capstone’s market outlook and is not intended to represent fund performance or be an indicator for how funds have performed or may perform in the future. Each illustration discussed in this document has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. This document is not an offer to sell or the solicitation of any offer to buy securities. Capstone is not recommending any trade and cannot since it is not a broker-dealer. Nothing in this document shall constitute a recommendation or endorsement to buy or sell any security or other financial instrument referenced in this document.

Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice.

Reference to Instruments and Indices:

References to indices are included for illustrative purposes only and are not intended to imply that any Capstone fund or account is similar to such index in composition or element of risk.

Bloomberg Global Aggregate Total Return Index: The Bloomberg Global Agg Index is a flagship measure of global investment grade debt from a multitude local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

Eurekahedge Long Volatility Index: The Eurekahedge Long Volatility Index is an equally weighted index. The index is designed to provide a broad measure of the performance of underlying hedge fund managers who take a net long view on implied volatility with a goal of positive absolute return. The index is base weighted at 100, does not contain duplicate funds and is denominated in local currencies. The underlying constituents will remain static as part of the migration from Eurekahedge to With Intelligence.

Société Générale Trend Index: The SG CTA Index is designed to track the largest 20 CTAs by AUM and be representative of the managed futures space. Managers must be open to new investment and report returns on a daily basis. The CTA Index is equally weighted, and rebalanced and reconstituted annually.

MSCI World Developed Index: The MSCI World Developed Index is a free-float weighted equity index. It was developed with a base value of 100 as of December 31, 1969. The MSCI World Developed Index includes developed world markets, and does not include emerging markets.

Notice to Investors in California

This message is provided for information purposes and should not be construed as a solicitation or offer to buy or sell any securities or related financial instruments in any jurisdiction. California residents should review Capstone’s California Privacy Notice: https://www.capstoneco.com/regulatory-disclosures/#california_consumer_privacy_act.

Notices to Investors Outside of the U.S.

Capstone is not registered, authorized or eligible for an exemption from registration in all jurisdictions. Therefore, services described in these materials may not be available in certain jurisdictions. These materials do not constitute an offer or solicitation where such actions are not authorized or lawful, and in some cases may only be provided at the initiative of the prospective investor. Further limitations on the availability of products or services described may be imposed. These materials are only intended for investors that meet qualifications as institutional investors as defined in the applicable jurisdiction where materials are received.

Notice to Investors in Australia

Capstone is regulated by the SEC under US laws, which differ from Australian laws. This material provided to you is factual in nature. It is not an offer or advice, and is not intended to recommend or state an opinion of Capstone. This document in its entirety is prepared by Capstone Investment Advisors, LLC (“Capstone”), a corporate authorized representative (number 1279754) of SILC Fiduciary Solutions Pty Ltd ACN 638 984 602 (AFSL 522145). The authority of Capstone is limited to providing financial product advice to wholesale clients. Investors should seek independent financial advice before making any investment decisions.

Before acting on any advice or information in this document you should consider, with or without the assistance of suitable expert advice, whether it is appropriate for your circumstances. To the maximum extent permitted by law, SILC, Capstone and their directors and officers disclaim all liability or responsibility whatsoever for any direct or indirect loss or damage of any kind which may be suffered by any person through relying on anything contained or omitted from this document, caused by viruses or faults contained in this document or otherwise arising out of the use of any part of the information contained in this document.

Notice to Investors in Canada

The content of these materials has not been reviewed by any Canadian Securities Regulatory Authority and does not constitute an offer to sell or a solicitation of an offer to buy securities in any jurisdiction where such offer or solicitation would be unlawful, and such content does not constitute an offer to sell or a solicitation of an offer to buy or an advertisement in respect of securities in any province or territory of Canada.

Notice to Investors in China

These materials, which have not been submitted to the Chinese Securities and Regulatory Commission, may not be supplied to the public in China or used in connection with any offer for the subscription or sale of interests in any investment product to the public in China.

Notice to Investors in the European Union and United Kingdom

These materials are only intended for investors that meet qualifications as institutional investors as defined in the applicable jurisdiction where materials are received, which includes only Professional Investors as defined by the Markets in Financial Instruments Directive (MiFID). These materials are not for use by retail clients and may not be reproduced or distributed without Capstone’s permission.

Notice to Investors in Hong Kong

Warning: The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the document. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

Notice to Investors in Japan

No filings have been made with respect to any of Capstone’s funds in Japan and the strategy is currently not intended for investment by Japanese investors. Thus, we are not providing this material to you for purposes of soliciting an investment in fund securities by you or your client investors, but rather to illustrate the manner in which we would plan to manage an asset management mandate (structured in a mutually acceptable and compliant form) granted to us by you should you so elect. By accepting this material, you acknowledge, confirm and agree that you have never been contacted by a representative of the fund or its manager in any manner which may amount to an offer to buy (or solicitation of an offer to buy) any interests in the fund in Japan.

Interests in the fund are a security set forth in Article 2, Paragraph 2, Item 6 of the Financial Instruments and Exchange Law of Japan (the “FIEA”). No public offering of interests in the fund is being made to investors resident in Japan and in accordance with Article 2, paragraph 3, Item 3, of the FIEA, no securities registration statement pursuant to Article 4, paragraph 1, of the FIEA has been made or will be made in respect to the offering of interests in the fund in Japan. The offering of interests in the fund in and investment management for the fund in Japan is made as “Special Exempted Business for Qualified Institutional Investors, Etc.” under Article 63, Paragraph 1, of the FIEA. Thus, interests in the fund are being offered only to certain investors in Japan. Neither the Fund nor any of its affiliates is or will be registered as a “financial instruments firm” pursuant to the FIEA. Neither the Financial Services Agency of Japan nor the Kanto Local Finance Bureau has passed upon the accuracy or adequacy of the Fund’s Offering Documents or otherwise approved or authorized the offering of interests in the fund to investors resident in Japan.

As of April 2024, Capstone Fund Services, LLC (“CFS”) and Capstone Fund Services II, LLC (“CFS II”) each have submitted Notification Form for Specially Permitted Businesses for Qualified Institutional Investors, etc. to the Kanto Local Finance Bureau in accordance with the FIEA. Each CFS and CFS II are organized for the purpose of engaging in any and all activities permitted under applicable law, including providing, directly or indirectly through Affiliates or joint ventures, a full range of investment advisory and management services. In connection with the foregoing, each of CFS and CFS II may serve as general partner or managing member (or in a similar capacity) with respect to other vehicles in the future, as determined by their Managing Member. Neither of the aforementioned funds nor any of its affiliates is or will be registered as a “Financial Instruments Business Operator” pursuant to the FIEA.

Notice to Investors in Korea

Capstone is not making any representation with respect to the eligibility of any recipients of this material to acquire any products managed by Capstone under the laws of Korea, including but without limitation the Foreign Exchange Transaction Act and Regulations thereunder. Capstone has not registered any shares with regards to any of its products under the Financial Investment Services and Capital Markets Act of Korea, and none of the shares may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in Korea or to any resident of Korea except pursuant to applicable laws and regulations of Korea.

Notice to Investors in Kuwait

This material has not been approved for distribution in the State of Kuwait by the Ministry of Commerce and Industry or the Central Bank of Kuwait or any other relevant Kuwaiti government agency. The distribution of this material is, therefore, restricted in accordance with law no. 31 of 1990 and law no. 7 of 2010, as amended. No private or public offering of securities is being made in the State of Kuwait, and no agreement relating to the sale of any securities will be concluded in the State of Kuwait. No marketing, solicitation or inducement activities are being used to offer or market securities in the State of Kuwait.

Notice to Investors in Russia

The securities (financial instruments) are not intended for placement in (or on the territory of) the Russian Federation and are not advertised or otherwise publicly marketed and/or offered for sale to the public in the Russian Federation. This confidential private placement memorandum is not subject to registration pursuant to Section 51.1 of the Russian Federal Law No. 39-FZ of April 22, 1996 (as amended) “on the Securities Market”.

Notice to Investors in Saudi Arabia

Capstone is not registered in any way by the Capital Market Authority or any other governmental authority in the Kingdom of Saudi Arabia. This presentation does not constitute and may not be used for the purpose of an offer or invitation.

Notice to Investors in Singapore

This material has not been submitted to the Monetary Authority of Singapore. Accordingly, this material and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of shares may not be circulated or distributed, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor pursuant to Section 304 of the Securities and Futures Act, Chapter 289 of Singapore (the “SFA”)) or (ii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Notice to Investors in Switzerland

The offer and the marketing of the fund’s Shares in Switzerland will be exclusively made to, and directed at, qualified investors (the “Qualified Investors”), as defined in Article 10(3) and (3ter) of the Swiss Collective Investment Schemes Act (“CISA”) and its implementing ordinance, at the exclusion of qualified investors with an opting-out pursuant to Art. 5(1) of the Swiss Federal Law on Financial Services (“FinSA”) and without any portfolio management or advisory relationship with a financial intermediary pursuant to Article 10(3ter) CISA (“Excluded Qualified Investors”). Accordingly, the fund has not been and will not be registered with the Swiss Financial Market Supervisory Authority (“FINMA”) and no representative or paying agent have been or will be appointed in Switzerland. This marketing materials, the Memorandum and/or any other offering or marketing materials relating to the fund’s Shares may be made available in Switzerland solely to Qualified Investors, at the exclusion of Excluded Qualified Investors. The legal documents of the fund may be obtained free of charge from [email protected].

Notice to Investors in the UAE

Capstone has not received authorization or licensing from the Central Bank of the UAE, the SCA or any other authority in the UAE to market or sell interests within the UAE. Nothing contained in this presentation is intended to constitute UAE investment, legal, tax, accounting or other professional advice. This presentation is for the informational purposes only and nothing in this presentation is intended to endorse or recommend a particular course of action. Prospective investors should consult with an appropriate professional for specific advice rendered on the basis of their situation.