Source: Bloomberg and Capstone

The Role of Volatility in Portfolio Completion

The global economy and financial markets are in constant flux. This volatility drives market dynamics. When fear drives markets, time speeds up and volatility rises, while during episodes of complacency, time and volatility slow down. Understanding the dynamics of volatility helps to uncover investor sentiment and expectations. The world of volatility has expanded over time and by now can be found everywhere within finance. Volatility has evolved from being an input needed to calculate the price of an option to a central pivot point needed to navigate global markets.

Although realistically risk is multi-faceted, volatility has generally been widely accepted as the major yardstick for measuring risk. As a consequence, volatility plays a central role in all existing risk management practices, which implies that changes in volatility will automatically affect risk budgets and positioning. For example, central banks aim to stabilize economic fundamentals, inflation, and financial market behavior. By suppressing volatility, they are able to stimulate risk appetite. As oftentimes stability begets instability, too much complacency induced by these central banks “puts” can potentially lead to excessive risk taking and result in valuation extremes. A risk event can disturb this fragile balance and trigger a reversal in sentiment. Rising volatility can spur de-risking and drive investors toward capitulation. Risk management and volatility swings have a tendency to amplify cyclicality.

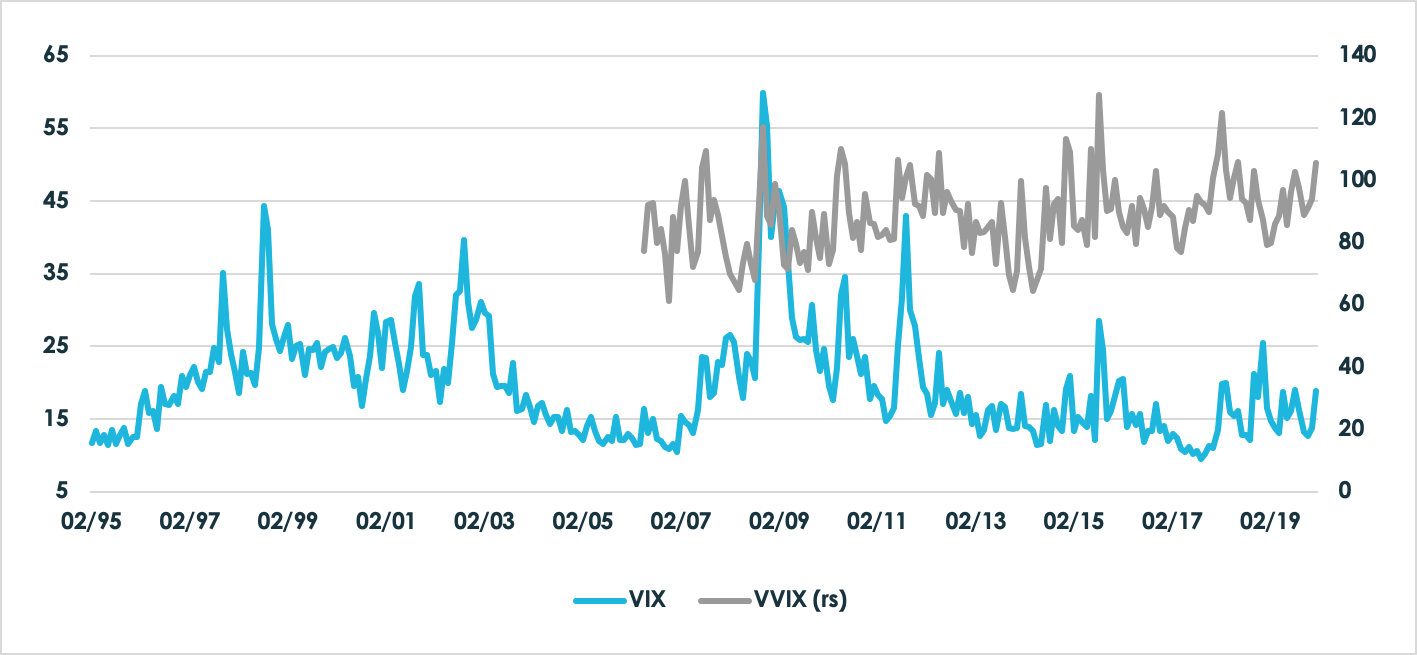

Understanding the role of volatility in portfolio construction and risk management has become more important than ever. The adoption of volatility scaling has gained continuous prominence as risk based portfolio construction concepts, such as risk parity, became more widely accepted. The more embedded the use of volatility has become in markets, the more volatility became a force in itself. From a historical perspective, volatility levels have moderated, with 2017 as an example of how low the levels can get, but those within the volatility space have also witnessed that volatility itself can become much more erratic. Chart 1 shows that S&P500 volatility has moderated, while the volatility of VIX has not.

Chart 1: VIX and Volatility of VIX

Although S&P 500 volatility, measured by the VIX, in 2017 hit historical lows, the volatility of volatility, measured by VVIX, stayed elevated. In February 2018, the muted volatility regime abruptly ended with the market now refers to as “Volmaggedon”, the capitulation event in crowded short volatility products. Using short-term volatility measures to scale exposures has the embedded risk of dialing up leverage when complacency and valuation levels are stretched. Knowing which volatility measures to use is therefore highly relevant.

When looking at volatility in the context of portfolio completion it is useful to distinguish four different perspectives:

Capital Preservation

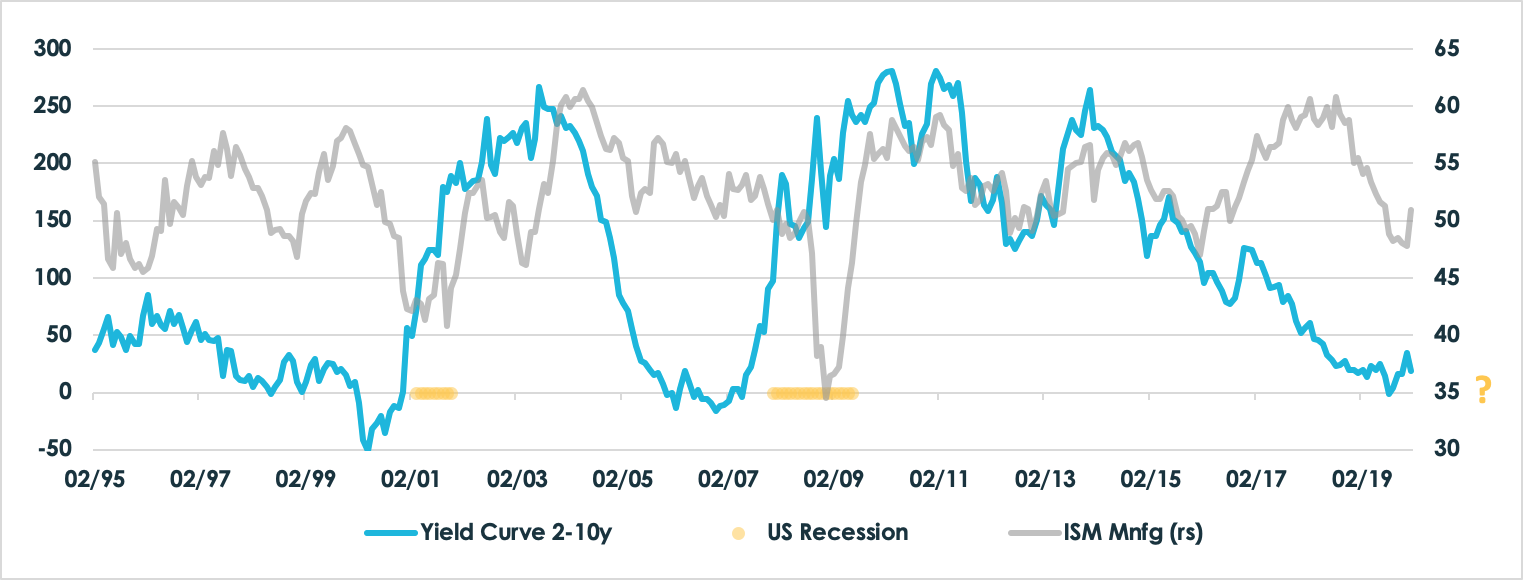

Currently, there is a growing sense of urgency amongst investors to anticipate a turnaround or correction of the bull market that started more than a decade ago. Several leading indicators, like flat to inverted global yield curves, and other leading indicators like the US manufacturing index, give rise to expectations of a recession and/or an equity bear market on a 1 to 3 year horizon. Chart 2 shows that the current flatness of the US yield curve and the level of the ISM manufacturing survey are at levels comparable to the ones we have seen ahead of the 2001 and 2008 recessions.

Chart 2: Yield curve and leading indicator recession warnings

Source: Bloomberg and Capstone

Volatility expertise is able to help protect a portfolio against various risk scenarios through tailored tail hedges. These can be focused on an asset class, but can also be customized to improve capital or funding status preservation during episodes of stress. The focus will be on adding an overlay that is negatively correlated in bad times.

Portfolio Efficiency

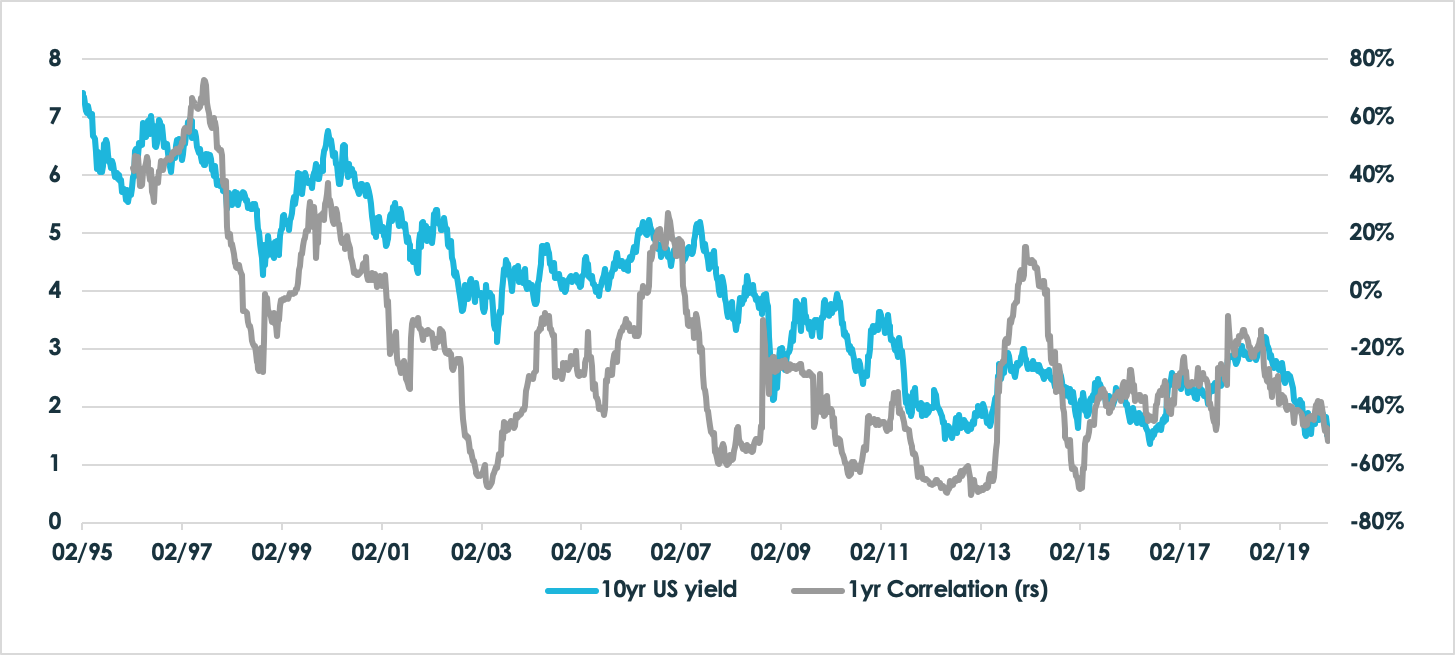

Capital-based portfolio implementation limits the scope to optimize its risk-return profile. For instance, a 60% allocation to equity typically implies that the equity factor drives about 90% of the portfolio from a risk perspective. For this reason, the concept of volatility scaling has become a widely used tool to balance portfolios as well as to scale trades and strategies. Risk parity investing, for example, uses this concept to improve the allocation to asset classes and return drivers and to construct a more robust portfolio than can otherwise be accomplished by allocating capital. One unit of capital can have a quite different risk profile as compared to another asset class and volatility scaling can help to manage concentration risks. The success of risk parity has profited significantly from both the bull market in bonds and the drop to historically low to negative yields in many developed markets and the negative correlation between equities and bonds.

Chart 3: Risk parity tailwinds; ever lower yields and a negative equity-bond return correlation

Source: Bloomberg and Capstone

Now that bond markets have become so expensive, the likelihood of a repeat of this goldilocks outcome seems low. This does not imply that the concept of risk scaling or risk allocation has lost added value, but it becomes more and more important to properly use the right volatility metrics. Volatility insight can help to improve a portfolio’s balance and avoid mistakes. Analyzing a portfolio from a volatility perspective offers new insights and adds an important extra degree of freedom that can used and translated into overlay portfolio construction strategies.

Risk Insights

To know what is needed in the context of portfolio completion, one needs to be able to look at a portfolio from different perspectives and in-depth knowledge of volatility can offer valuable insights. For example, despite the paradigm that taking more risk should be rewarded by a higher return, volatility can also be harmful to wealth. A return sequence of -10% followed by +10% leaves a gap of 1%. Volatility awareness and management are essential in portfolio and risk management. There is a rich history of market behavior in good and bad times. This has enabled managers to build stress tests, simulate portfolio behavior through historical simulations, and find hidden factor exposures and unintended concentrations. Volatility levels and curves, skew, correlations and several other greeks can reveal discounted fear or complacency in the market place. This information can be used to improve the awareness of embedded risks and sensitivities.

Volatility is everywhere

Although we seem to live in a time of muted volatility if seen in the context of geopolitical uncertainty, shifting relationships between the major powers and central banks reaching the end of their ability to further loosen monetary policy to counteract disappointing fundamental growth, volatility itself has continuously gained importance. Insight in the world of volatility offers a wide range of opportunities to use in the context of portfolio completion.

Important Disclosures

This white paper (the “White Paper”) has been provided by Capstone Investments Advisors, LLC (“Capstone”) for educational and informational purposes only.

This White Paper does not constitute an offer to sell or a solicitation to buy any securities, financial instruments or other products, and may not be relied upon in connection with any offer or sale of securities or other financial instruments. This communication is provided for information purposes only. In addition, because this communication is only a high-level summary; it does not contain all material terms pertinent to an investment decision. This White Paper in and of itself should not form the basis for any investment decision.

Financial instruments and investment opportunities discussed or referenced herein may not be suitable for all investors, and potential investors must make an independent assessment of the appropriateness of any transaction in light of their own objectives and circumstances, including the possible risk and benefits of entering into such a transaction. An investor engaging in the trading strategies described herein could lose all or a substantial amount of his or her investment. The products and strategies described herein may involve above-average risk.

Unless otherwise indicated, the information contained in this White Paper is current as of February 11, 2020. Such information is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the information and opinions. Additionally, there is no obligation to update, modify or amend this White Paper or to otherwise notify a reader in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate or other market or economic measure.

Capstone is not acting and does not purport to act in any way as an adviser or in a fiduciary capacity vis-à-vis readers of this White Paper. You may not rely on any on this White Paper as investment advice or as a recommendation (personal or otherwise) to engage in any strategy and/or enter into any transaction described herein. Accordingly Capstone is under no obligation to, and shall not, determine the suitability for you of any strategy and/or any related transactions described herein. You must determine, on your own behalf or through independent professional advice, the merits, terms, conditions, risks, suitability and appropriateness of any strategy and/or any related transactions described herein. You must also satisfy yourself that you are capable of assuming, and assume, the risks of any such strategy and/or any related transactions securities and consult your own legal, tax, accounting and other advisers as to such matters.